As if inflation, a sluggish economy, and increasing interest rates weren’t enough, multifamily residential property managers and owners are dealing with some challenging trends. The most troublesome trend is the skyrocketing cost of insurance. Property coverage is far more expensive than it has been in recent years. It’s causing policyholders to increase deductibles and insurance companies to add policy limitations such as lowering the coverage amount to reduce their exposure.

According to a Multifamily Dive survey and from the National Multifamily Housing Council (NHMC), respondents said their multifamily property insurance costs went up by an average of 26% in the past year. Some indicated theirs went up as high as 120%! In response to the higher costs, 61% of the respondents increased their deductibles to ensure affordability.

What’s Causing the Soaring Insurance Costs for Multifamily?

Many factors contribute to the outrageous surge in insurance costs. One factor is that more natural disasters have been happening in the last few years. These increase the risk for multifamily residential properties. Natural disasters in 2021 and 2022 have caused the most damage and cost the most.

According to NOAA National Centers for Environmental Information, the first half of 2022 had nine events, which cost almost $1 billion per event. Climate.gov indicates the 22 events in 2022 put the year in a three-way tie with 2017 and 2011 for the third-highest number of billion-dollar disasters in a 12-month period.

NOAA data indicates there were 20 events in 2021 resulting in over 700 deaths and a $152 billion bill. Unfortunately, 2021 was the second highest year in the number of events, the sixth highest in deaths, and the third highest in cost.

More than 14 million single- and multi-family homes have been affected by these events per the 2021 CoreLogic Climate Change Catastrophe Report. This equates to approximately one out of every 10 U.S. residential properties. Moreover, five of the top 10 most economically expensive disasters in the U.S. happened in 2021 as shown in 2021 Disasters in numbers from the UN Office for the Coordination of Humanitarian Affairs (OCHA) ReliefWeb report.

The natural disasters occurring in recent years have shown that they can happen to anyone regardless of where they’re geographically located. Business and multifamily residential properties in Texas probably thought they’d never have to worry about a snowstorm. February 2021 proved everyone wrong.

Just about the entire state of Texas shut down. Businesses, retail centers, and schools stood empty. The mail carriers couldn’t deliver mail. Truckers couldn’t drive across the state. The icy roads became treacherous. It wasn’t just Texas that experienced an unexpected weather event.

Seven months later, another part of the U.S. had its own natural disaster – Hurricane Ida. This Category 4 hurricane turned out to be the second most damaging hurricane in the U.S. to reach land. Hurricane Ida had the distinction of being the strongest hurricane ever in Louisiana history according to a CW39 story.

Hurricane Ian killed 147 people in Florida, a state record with damage to the tune of $112 billion according to Climate.gov. The Category 4 hurricane had winds of 150 mph that swept away many coastal areas. Some areas experienced more than 20 inches of rain. Hurricane Ian was one of the most expensive natural events in 2022.

These natural disasters are forcing some insurance companies to be selective about where the properties are located. A few companies have left some markets because they were too expensive to cover. A Biz Journal story says State Farm Insurance left California and they’re not the only ones. It turns out Florida accounts for 80% of all property insurance claims in the U.S.

The other factor is the rising price tag for construction materials and labor along with the supply chain problems that have yet to return to pre-COVID levels.

How Can Multifamily Counteract the Insurance High Costs?

Developers and multifamily property managers are under a lot of pressure because of the insurance costs. The costs are crushing the industry as deals have fallen through. Many in the industry are calling for lending reform, lender flexibility, and government support.

What can multifamily residential property managers and owners do about the high cost of insurance? They certainly can’t stop natural disasters from occurring. However, it’s possible to get creative in finding savings elsewhere. Here are some options.

1. Protect yourself from identification theft and fraud

Multifamily properties can help protect themselves from identity theft and fraud by implementing robust identity verification measures. By utilizing advanced screening solutions, property managers can verify the authenticity of prospective residents’ identities, ensuring they are who they claim to be. These solutions include comprehensive background checks, identity verification tools, and credit screening services, which help detect fraudulent activities such as stolen identities or false information.

Additionally, multifamily properties can also implement secure online application processes and encryption technologies to safeguard sensitive resident data, minimizing the risk of unauthorized access or data breaches.

2. Conduct regular inspections

Cars that undergo regular maintenance tend to last longer and cost less than those that don’t. This is because owners are being proactive in getting their vehicles checked out. It allows them to catch problems early and fix them, which is cheaper than waiting until something breaks.

Regular inspections can catch problems early. Whenever doing an inspection, document it and take pictures. These are useful for insurance claims. Some areas of the multifamily residential property may need more frequent inspections than others. High-traffic and public spaces will need more inspections than low-use areas. Don’t forget to inspect the landscaping and lighting. Overgrown shrubbery and broken lights can lead to crimes.

It’s crucial to have regular maintenance for HVAC systems. This prevents unhappy residents whenever the HVAC stops working. A building that’s too hot or too cold can lead to expensive problems.

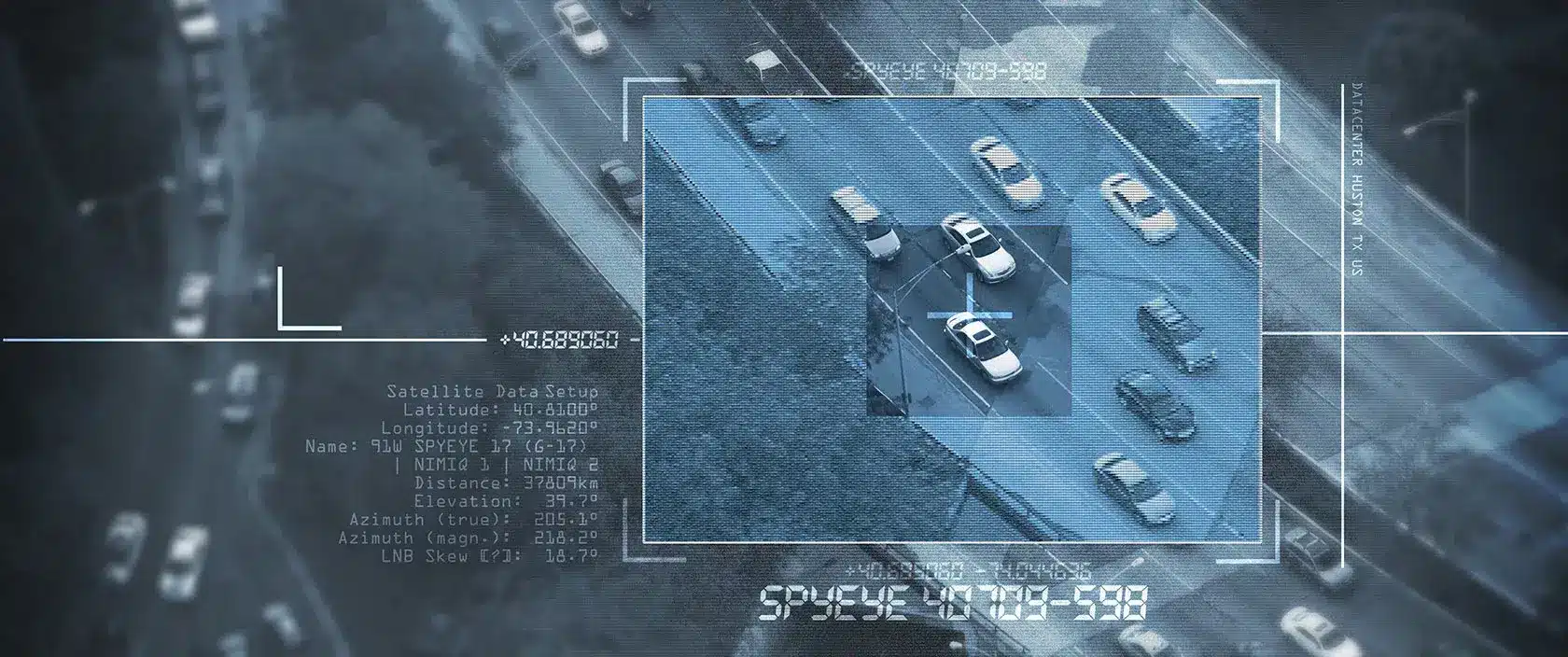

3. Reduce risk with security technology

There is one way to reduce risk and potentially lower insurance premiums. Obviously, you can’t lower your risk when it comes to natural disasters. But you can for other things like crime prevention. Integrated security systems with live video surveillance and an access control system have the potential to do that. It also delivers many more benefits.

Insurance companies may lower premiums when they see the multifamily residential property has taken steps to reduce risk. The lower the risk, the lower the insurance premiums.

A live video surveillance system consists of security cameras posted inside and outside the multifamily residential property. A trained monitoring operator and video analytics watch every camera in real time to help catch suspicious activity.

This process often results in the police responding faster and stopping the intruders before they cause damage or get away. Therefore, this security system helps mitigate losses. It has the ability to do more than deter crime and limit damage.

The integrated security system can help enhance resident, employee, and vendor safety. Security cameras with remote monitoring are also helpful with health and safety. It’s possible for monitoring to find and report fall hazards and other dangerous conditions for residents, employees, and visitors.

The access control system manages who can and cannot access any part of the property. This lets you control who can enter the staff area, communal places like the laundry room and swimming pool, and any place else with limited access. This reduces the chances of unauthorized access.

A video surveillance system can include an onsite speaker. This allows the monitoring operator to warn anyone who shouldn’t be on the property. Here’s a video of a child who climbed the multifamily residential fence surrounding the swimming pool. This could have ended in a tragedy if it weren’t for the operator’s warning. Thankfully, the child climbed back down and ran away.

The human monitoring operators do not work on the multifamily residential property. They work in a remote location and their lives are never at risk.

Multifamily Residential Video Surveillance and Monitoring Benefits

Live video surveillance helps reduce multifamily residential risk, boost safety, and bolster security. It can save time and money because it helps deter crime, prevent injuries, and lower liability. All video recordings are stored for access as needed. This gives you any evidence you need for insurance, law enforcement, and lawyers.

Many of Stealth Monitoring’s multifamily residential clients are surprised by the cost savings. Stealth clients have seen a return on their security investment within months. This maximizes the net operating income (NOI).

They gained an unexpected bonus in implementing live video surveillance. It turns out many of their residents considered it a must-have amenity. The amenity can make a difference in the resident choosing your property over a competitor. Residents want to find a place they can call home and feel safe. Integrated security with live video surveillance and an access control system delivers that.

The multifamily residential industry is different from other industries when it comes to security requirements. To fully benefit from video surveillance with monitoring, find a partner that has experience working with the multifamily residential industry. Stealth is one of them. To help you in your search for a security partner, use this video surveillance checklist. To learn more, pick up the Complete Guide to Securing Your Multifamily Residential Property or contact us.

Texas Private Security License Number: B14187

California Alarm Operator License Number: ACO7876

Florida Alarm System Contractor I License Number: EF20001598

Tennessee Alarm Contracting Company License Number: 2294

Virginia Private Security Services Business License Number: 11-19499

Alabama Electronic Security License # 002116

Canada TSBC License: LEL0200704