If the trucking industry was compared to cars, then last year contained a lot of breakdowns and flat tires. What does this next year have in store? Trucking industry reports indicate that while the trucking industry faced tough conditions in 2023, the market is not expected to worsen in 2024. Here’s a closer look at the information coming in.

Top Trucking Industry Challenges from ATRI’s Survey

The American Transportation Research Institute has published the results from its Critical Issues in the Trucking Industry Survey. It opens with a description of the top breakdowns for the trucking industry. These include high inflation, flat housing and manufacturing output, climbing fuel prices, and retailers dealing with overstock as inflation forced customers to be conscious of spending decisions.

Moreover, the jobs in the industry also fell for the first time since the pandemic and the number of registered carriers did not see much growth. The United Auto Workers (UAW) strike against the big three automakers reverberated across multiple industries including trucking and transportation. And Yellow, a 99-year-old trucking company, shut down and laid off 30,000 workers.

State and federal governments issued new mandates to drive the nation to work toward zero-emission vehicles. All the news was not bad, however. The government delivered good news through the 2021 Infrastructure Investment and Jobs Act (IIJA). This allows the federal government to funnel money to state and local governments for infrastructure projects. Such projects include roads, public transportation, and more. All of these depend on the trucking industry.

The IIJA allowed the federal government to send new funding to state and local governments for infrastructure projects. These relate to broadband, bridges, public transit, roads, and water. Like the CHIPS Act, IIJA aims to boost the economy. Additionally, the government issued the Inflation Reduction Act (IRA) to boost business practices to counteract climate change and inflation.

What are the top trucking industry issues according to ATRI’s report? The economy, truck parking, fuel prices, and driver shortage. While the trucking industry doesn’t have control over the economy, ATRI says trucking companies can “quantify the impact of increasing trucking operational costs on the supply chain and nation’s economy.”

They also recommend advocating for reshoring and near-shoring of parts and equipment to cut international supply chain dependency. This is where the CHIPS and Science Act (CHIPS) of 2022 comes in. The purpose of the CHIPS Act is to invest more than $50 billion in U.S. semiconductor manufacturing facilities, research and development, and workforce. It also came with a 25% tax credit for capital investment in related projects.

Concerns about truck parking problems aren’t new. It’s been a top 10 problem since 2012. The IIJA is supposed to help alleviate the problem, as it increased funding for truck parking projects.

Similar advocacy will help with the other challenges. As for the lack of drivers, as part of IIJA, the Drive Safe Act made it possible to allow 18- to 20-year-olds to be eligible for a commercial driver’s license (CDL). Unfortunately, the FMCSA Safe Driver Apprentice Program (SDAP) isn’t generating enough interest.

Updates from DAT and FTR Market Data

DAT Freight and Analysis and FTR Transportation Intelligence posted the current load volumes, truck posts, and freight rates according to a FleetOwner article. Both firms agree that general freight rates for trucks are down year over year. The decrease suggests that carriers may face tighter profit margins. Shippers, on the other hand, could benefit from lower transportation costs.

However, there’s a discrepancy in recorded changes for load volumes and truck posts. DAT observed a significant decrease in truck availability with a slight increase in load posts, while FTR reported a slight decrease in load posts and a slight increase in truck availability. The discrepancy in load volumes and truck posts indicates a complex market. Carriers may need to adapt to changing demand patterns, especially if load volumes continue to fluctuate.

As for load-to-truck ratios, DAT measured an increase for vans and reefers, but a decrease for flatbeds. FTR’s Market Demand Index showed a slight decline due to falling loads and rising truck postings.

The varying load-to-truck ratios across equipment types highlight specific challenges. Carriers with van and reefer equipment may find increased demand relative to available trucks, potentially leading to better rates. Carriers with flatbeds may face tougher competition due to decreased demand relative to available trucks.

And finally, on rate changes, FTR noted a slight increase in broker-posted rates week over week, but a 2% decrease year over year. DAT reported decreases in linehaul rates for all equipment types, both week over week and year over year.

The mixed rate changes reported by FTR and DAT emphasize the need for carriers and brokers to stay informed. While broker-posted rates increased slightly week over week, the year-over-year decrease in linehaul rates warrants attention.

What Are the Key Takeaways for the Trucking Industry?

Carriers must continue to monitor market dynamics, adjust capacity as needed, and negotiate rates strategically. Shippers can leverage lower rates but should also consider service quality and reliability when selecting carriers. Overall, the industry’s resilience and adaptability will be crucial in navigating these market shifts.

The 2024 outlook for the trucking industry is cautiously optimistic, with expectations of a slow recovery. One of the key takeaways is that indicators suggest a gradual tightening of capacity, which could lead to a market turnaround in the second half of the year. Another major issue has been excess capacity. However, as freight volumes and rates continue to pressure carriers, this should eventually align with demand.

For a significant recovery, the industry requires stronger freight demand, which is currently forecasted to be less than 1% growth this year. To navigate these conditions, trucking companies may need to focus on efficiency, cost management, and preparing for increased freight demand and tighter capacity in the future.

How the Trucking Industry Can Increase Efficiency and Cost Management

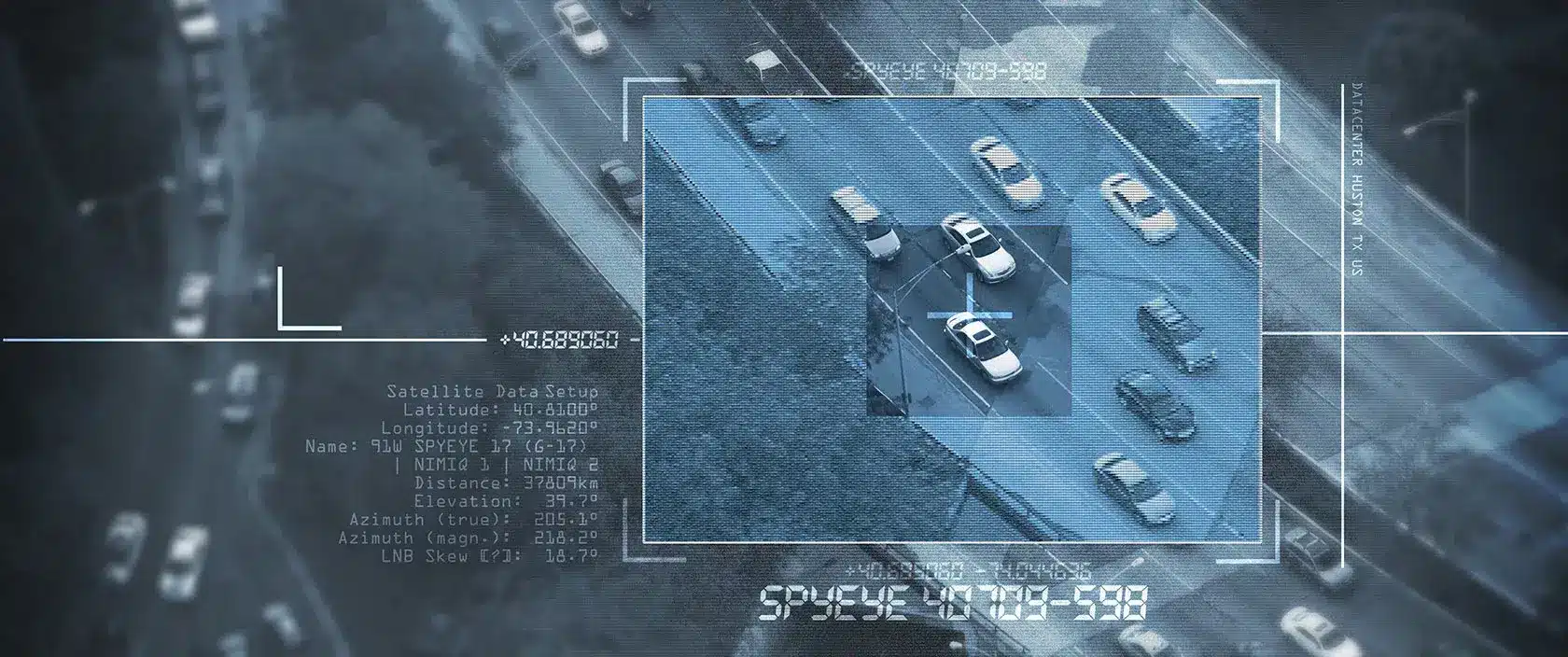

Based on the data, it’s critical for the trucking industry to look for process improvement opportunities to increase output and efficiency while reining in costs. An effective way to do that is with remote video surveillance. Trucking companies can gain instant insights and a bird’s eye view into their operations.

The video cameras can monitor traffic flow, track goods movement, and capture safety risks. As soon as any potential problems pop up, leaders can swiftly respond to resolve the problems. It can be challenging to identify areas for improvement when you’re on the ground. The higher views can help see potential bottlenecks, traffic patterns, layouts, and storage.

Of course, remote video surveillance can do more than help improve operations efficiency. It’s not your typical security technology. Unlike traditional security systems, video surveillance with remote monitoring is a proactive security system. The remote monitoring component is what makes it so effective. Remote monitoring means artificial intelligence and trained monitoring operators work together to watch over your trucking and business assets in real-time.

The advantage of remote monitoring is that the monitoring operator is not located at the trucking business property. Even though they’re not onsite, they can issue warnings on an onsite speaker. If trespassers don’t hear or heed the warning, then the operator can call the police. Often, the police can get to the site before the intruders escape.

Security cameras and remote monitoring can lead to cost savings on insurance and repairs. Companies that use video cameras can prove to their insurance company that they’ve taken steps to protect the business. This can reduce premiums. Besides, liability lawsuits are difficult cases to win as they depend on what people say. The cameras may provide the needed evidence to show the court the business is not at fault.

Insurance companies may offer discounts on premiums because proactive surveillance acts as a deterrent against theft and vandalism. They know it helps create a safer environment for employees and customers while reducing the risk of crimes.

Improving a trucking business takes time, effort, and an inclination to adjust to changing market trends and conditions. Incorporating video cameras and remote monitoring lets you focus on finding and fixing inefficiencies in operations. As a result, it can help boost profit margins to ensure a trucking business is successful and sustainable and delivers positive results.

Partner with Stealth Monitoring

Stealth Monitoring’s clients and partners often experience a fast return on investment. The company has experience in working with trucking and transportation companies. Stealth works with many businesses across the U.S. and Canada. Stealth partners gain access to law enforcement. That’s because Stealth has partnerships with law enforcement all over North America.

The benefit of these partnerships is that law enforcement is more likely to respond when they get a call from Stealth. They know Stealth has video verification that something is happening on the property.

Here are some videos of video surveillance in action:

- Suspects try to steal cargo.

- Trespassers attempt to steal trucks.

- Thieves caught tampering with trailer.

- Intruder tries to access delivery trucks.

- Arsonists caught starting a fire on a loading dock.

For deeper insights into transportation security, check out the guide on the Effects of Crime on the Transportation Industry. To learn more, contact us today.

Texas Private Security License Number: B14187

California Alarm Operator License Number: ACO7876

Florida Alarm System Contractor I License Number: EF20001598

Tennessee Alarm Contracting Company License Number: 2294

Virginia Private Security Services Business License Number: 11-19499

Alabama Electronic Security License # 002116

Canada TSBC License: LEL0200704