The real estate market is facing a transformative phase, with industry leaders and experts sharing their perspectives on its future. During the IMN Distressed CRE West Forum, an event from the Information Management Network (IMN), Joe Curd, Stealth’s Director of National Accounts, participated in a panel discussion called, “Where Will the Skeletons Be Hidden This Time Around, Identifying & Managing the Biggest Risks.” Several industry experts joined Joe to discuss where the market is headed and the factors influencing its current path.

The State of the Market

Andrew Lam, Director and Co-Head of Acquisitions and Originations at Taconic Capital, addressed the market’s current situation. He acknowledged that the post-ERP (Enterprise Resource Planning) era has resulted in a challenging period for many real estate stakeholders. The rapid increase in interest rates and inflation has created uncertainty and hesitation among both borrowers and lenders. However, he pointed out that market consistency is gradually returning, and capital is being accumulated on the sidelines, ready for deployment.

Maya Theuer, the CEO of Redwood Residential, stressed the importance of being cautious and realistic in the current market conditions. Although there has been some recovery, the market still has significant weaknesses that need to be addressed. She highlighted the need for careful underwriting and strategy development, taking into account both macroeconomic and industry-specific factors.

Opportunities and Risks in the Market

Joe Curd expanded on the topic by addressing key risks impacting the real estate market. He emphasized the importance of managing these risks effectively, particularly in sectors that fall within the traditional “four food groups” of real estate: office, industrial, retail, and multifamily.

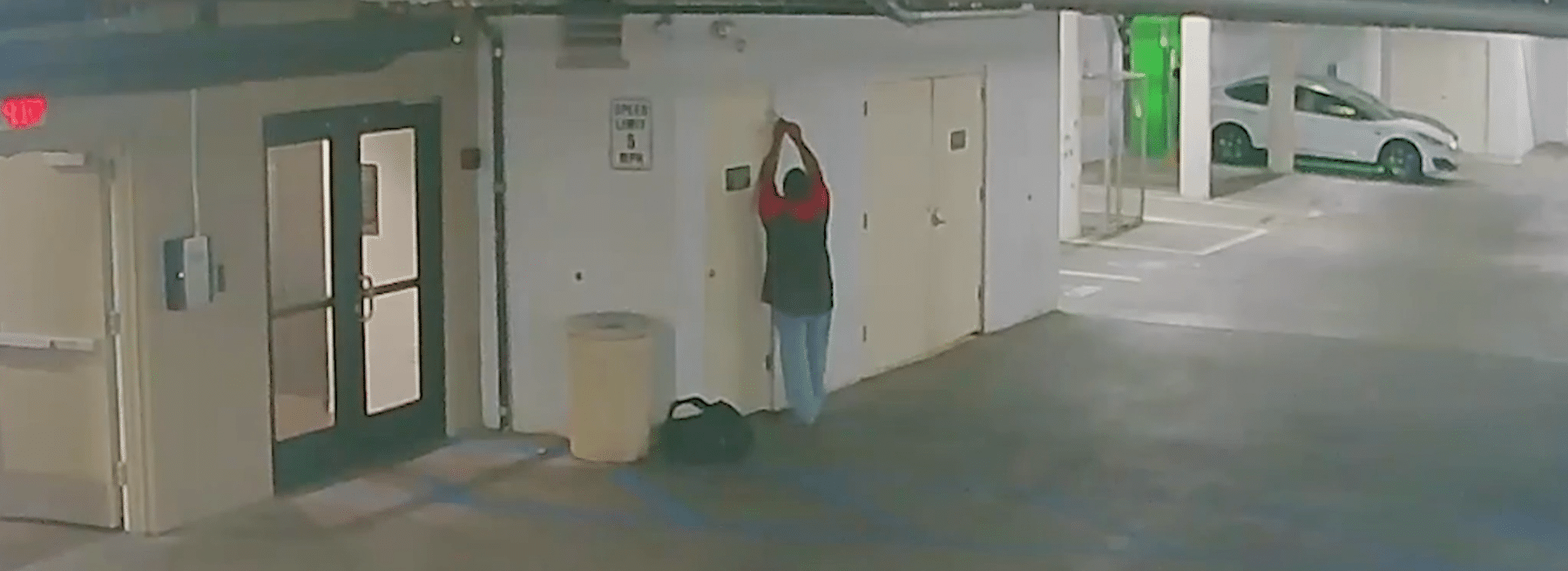

Curd also stressed the growing importance of security concerns in the multifamily sector, noting how issues like car theft, package theft, and mail theft have surged. These crimes can deter potential renters, lead to high turnover rates, and impact the sector’s overall stability.

Marc Grayson, who serves as President and Co-Founder of RRA Capital, shared some interesting insights alongside Dags Chen, Managing Director and Head of U.S. Real Estate Research and Strategy at Barings. The two explored where they see emerging opportunities in today’s market.

Grayson pointed out a few niche areas gaining traction with investors, like mobile home communities, industrial outdoor storage facilities, and affordable workforce housing projects. He feels these kinds of thematic strategies could deliver attractive returns going forward.

Meanwhile, Chen emphasized the need for a really targeted, careful approach when investing right now. With structural changes impacting certain sectors – such as rising insurance costs and geopolitical factors causing disruptions – he stressed the importance of making precise, well-researched investment decisions.

Chen also drove home the value of really leaning on all the data out there to steer your investment decisions. He pointed out how the U.S. real estate market is pretty transparent compared to other markets around the world. Having that visibility into trends and metrics can definitely help shape a smart, data-backed investment thesis.

The panelists also highlighted the importance of keeping a pulse on what’s happening in the REIT world. Getting a handle on public real estate investment trusts allows you to better anticipate shifts and opportunities that may open up for private real estate strategies down the line. Staying tapped into that space provides useful signals for the private side of the market.

Protecting Valuable Real Estate Assets

At the end of the day, safeguarding valuable real estate assets through cutting-edge security solutions like live video monitoring is paramount for mitigating risks, preventing losses, and ensuring the long-term success of any real estate investment or development project. Whether it’s a commercial property, construction site, or multifamily residential community, these valuable holdings demand comprehensive protection strategies.

Live video monitoring provides a proactive approach to security by leveraging cutting-edge surveillance technology combined with human intelligence. Trained monitoring operators can remotely watch over properties in real-time through an integrated camera system.

At the first sign of suspicious activity, these operators can promptly activate speaker warnings to deter potential criminals. If the situation escalates, they can coordinate with local authorities to dispatch emergency responders.

This real-time remote monitoring acts as a virtual security force, helping to enhance safety while reducing the need for on-site guards. It helps deter incidents before they occur and allows for a faster response when intervention is required.

For property owners and managers, live video monitoring can deliver peace of mind and mitigate devastating costs associated with property damage, criminal activity, and legal liabilities. As an innovative security solution, it has become an invaluable tool for protecting the substantial investments made in real estate holdings.

If you would like more information about live video monitoring can help streamline processes, reduce costs, and deliver a powerful ROI, get your free copy of How to Monetize Security | Stealth Monitoring. Still have questions? Contact us.

Texas Private Security License Number: B14187

California Alarm Operator License Number: ACO7876

Florida Alarm System Contractor I License Number: EF20001598

Tennessee Alarm Contracting Company License Number: 2294

Virginia Private Security Services Business License Number: 11-19499

Alabama Electronic Security License # 002116

Canada TSBC License: LEL0200704